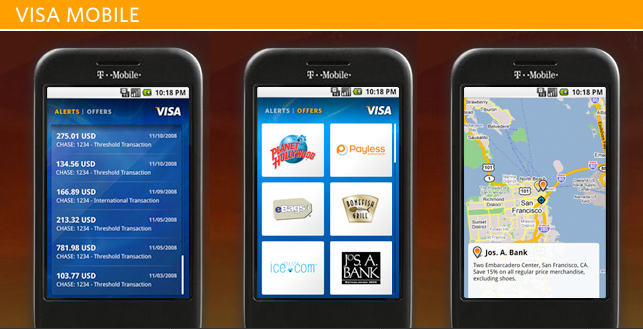

Starting this morning, the Visa Mobile Application became available on the Android Market. We’re pretty excited because it’s the first financial application for Android from a “heavy hitter” and it offers some great features of which at the moment, only select Chase Visa card holders can take advantage.

- Alerts – track your card transactions WHEN they happen. Keep tabs on your own expenses and if someone ELSE is using your credit card, you’ll instantly know.

- Offers – get coupons on your phone, display them at the retail counter and get discounts. You can also redeem some coupons online.

- Locator – find stores closeby where you can redeem offers.

Here is a quick overview video:

My favorite feature on this phone is the ability to track purchases. With all the scam artists out there people are rightfully becoming increasinly paranoid about their personal data and the Visa Mobile App offers an instantaneous reporting solution so you can always keep tabs.

The “Offers” and “Locator” features are of secondary importance in my own opinion, but that all depends on the quality of offers, number of offers, exclusivity of offers and all that jazz. It’ll be interesting to track the development of the offers and see what type of deals Visa helps you find and get with the Visa Mobile App.

Just as we did with the Android Market Terms of Service, we’ve read through some of the nitty gritty details to save you the trouble and we found a BUNCH of stuff you’re going to want to remember:

- To opt out of mobile alerts at any time, text “alerts STOP” to MVISA

- To opt oiut of mobile offers text “offers STOP” to MVISA

- If you delete the application it doesn’t mean you’ve terminated your participation… you have to text “STOP”, “END”, “CANCEL” or “UNSUBSCRIBE” to MVISA to do so.

- Personal information is stored by VISA but will only be used to comply with the law and not sell your information to marketing firms or any of those types of shenanigans.

If you’re like me, you may be somewhat hesitant about downloading an application that discloses very important personal information with the word BETA stamped on the end. In the Terms they even state that, “unfortunately, no data transmission via a mobile handset can be guaranteed to be 100% secure.” To be honest, they kind of have to give themselves an “out”. Do you think they would want to be held responsible if a T-Mobile flub up resulted in their own data being breached? I think this is more housekeeping than anything else and would personally be completely comfortable using this app.

The Terms also state that the app is for use on T-Mobile Android handsets only, so there is no telling what will happen when more handsets are released on additional carriers. I don’t own a CHASE Visa card so I was unable to test the application but thus far it has 4 out of 5 stars and has received generally good market comments.

If you’re a G1 toting Chase VISA card holder download the app, give it a test drive and let us know how you like it and what kind of offers/coupons you have access to! A video would be nice too.. but we won’t press our luck…

OK, this will be incredibly sweet when it’s available to partner cardholders. Buy.com, Amazon.com, BP, and Southwest Airlines are major players whose cards are through Chase and Visa.

Quote:“We’re pretty excited because it’s the first financial application for Android from a “heavy hitter””

Um…what about the Bank of America mobile app that was out on day 1?

As the largest bank in North America and #3 in the world, I would say that’s a pretty heavy hitter.

Sounds like sour grape’s J.

Awesome!!!!! I hope Discover and other card’s pick this kind of app up.

Sour grapes?

Color me confused. I bank with BofA. I’ve had an app on my G1 since Day One that I use and love.

I don’t have a Chase Visa, so while it’s true that this app wouldn’t do me a lick of good, I’m not crying about it.

I’m simply pointing out that the article contained inaccurate information, i.e. that Chase isn’t the first “heavy hitter” to the market, and that their status as a “heavy hitter” (being the 2nd largest bank in America) sets a criterea that BofA meets.

I had got a desire to start my own commerce, nevertheless I did not have enough of cash to do it. Thank God my fellow said to take the personal loans. So I took the college loan and made real my desire.