Let me tell you something about myself: I’m young, irresponsible, and check my bank account balance once every two months (if that). It’s not that I’m sitting so comfortably that I never need to check; it’s more the opposite. I live in constant paranoia about my funds and stand by the maxim “out of sight, out of mind.” Keep spending without discretion, hope that the money in my bank account will back it up.

This is a terrible way to manage one’s finances. I know this. I don’t recommend it. I’ve tried the services of several app-centric startups throughout the years in order to wrangle some savings out of my constant spending, but they all require too much work. I still get a weekly update email from Mint, a service I have not logged into for at least three years.

So when an acquaintance on Twitter said he has been letting a so-called SMS robot manage his savings for the past few months, my curiosity was instantly piqued. I know this is probably not the norm, and for good reason. Most don’t trust even living people with managing their money let alone a software robot that only communicates via text. Would you really want SmarterChild’s cousin going anywhere near your money? But, sadly, my method of handling personal finances is all too common among young people. I figured maybe it is time I throw in the towel and let an algorithm tell me how to save.

The algorithm is the genius of a new startup called Digit. And, yes, algorithm is a more appropriate description of the service than SMS robot (though not quite as catchy). It is true that Digit sends its savings updates and is managed entirely via SMS, but it all comes back to the algorithm. This algorithm scans your bank account activity — I know that makes you nervous, giving a little-known startup the keys to your Spaghettios money — and, based on the flow of funds in and out, determines how much you can afford to put away.

It’s a little amount every two or three days, typically no more than the cost of lunch, and Digit promises to never take more than $50 in one go (the smallest amount I have seen was around $5 while the highest bordered on $20). The money is siphoned off into an FDIC-insured Digit account where it can be withdrawn back to your checking account at any time. Just text your little SMS buddy and he’ll have your money on its way.

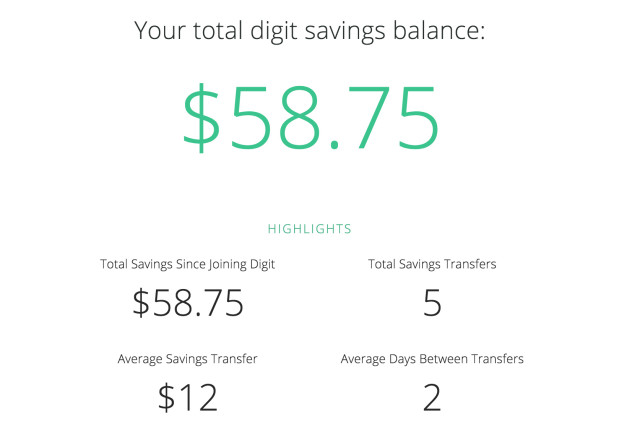

The secret sauce that Digit uses to determine how much you can save is as mysterious to me as any, but I am here to say it works. In just a few weeks of using Digit I have seen it quietly squirrel away close to $100 worth of savings. And every bit of their advertising copy was right. I barely noticed. The amounts taken never compromised my spending ability, and now I have a small but growing nest egg to hold onto for when I really need it (or in my case, to save up for some travel I plan on doing later this year).

There is a catch to using Digit versus a traditional savings account. You won’t earn any interest on the money you hoard away. In fact, Digit funds its operation by collecting interest earned on your money. But there is no limit to how soon and how much you can withdraw from Digit, so if interest is your game you can very easily utilize Digit’s algorithm to save cash and then transfer said cash to a more traditional savings account. Digit’s longterm goals include offering users the ability to earn returns on savings, so it comes off as only a minor inconvenience in the interim.

Digit is especially great for those that think they can’t afford to save. The reality is everyone can and should be setting some money aside, no matter how small their income. It took an SMS robot to convince me of that fact, but now I’m all for it.

Digit recently left beta and is now open to the public. If it sounds like something you’d be into, follow this link to sign up for an account.

I don’t see managing my money with an insecure protocol like SMS as being anything but highly irresponsible.

It’s worth clarifying that no sensitive info is actually sent via SMS. Logins occur via their main webpage and Digit promises “state-of-the-art security measures. Your personal information is anonymized, encrypted and securely stored. All funds held within Digit are FDIC insured up to a balance of $250,000.”

Don’t let your balances be low because the algorithm that they use isn’t very good. I had a little bit of money in the account and they withdrew more than that and made my account go negative. I contacted them and they said their policy is to refund any charges that they caused. Haven’t seen that yet but good to know that they would in case and also the FDIC insurance is also nice.

I’m giving this a try for a month. If it’s not what it’s up to be I’m coming for ya Kevin lol

I don’t know if my original reply posted any who, please let me know after your months review if it works out and it’s honorable. I live solely on my disability due to cancer so have very little money to do anything with. However I would very much like to squirrel away a few pennies. I’m not sure how you can contact but I’m down for any suggestions. Thanks, I remain 1badelf.

I kind of read into it and it seems promising but something in my gut is just telling me to deal with an automatic deposit savings account. If you’re looking into saving try squaring away $5 to $10 a month that way.

Yeah my gut tells me to stay away. As you suggest probably just automatic 10 dollars a month into s savings account. When your giving your actual sign in info to a messaging service is like answering one of those I won 10 million dollars and if you give me your name address phone number and occupation ilk give you 5 million of it. Yep I jump on it every time I received one which is at least there times a week. Not.. Thanks….

Been putting away $25 a paycheck for years and have built a nice little cushion.

Would have to pass on that math…

I always check how much money is left a couple of days before I get paid and make a deposit with that amount when I get my salary.

This is actually very smart! Thanks for a tip. I’m going to switch jobs soon from being contractor (for long years) to a full time position, and this will help me get the control back in my hands.

Another good tip is to split your bills in half. So on one check you pay rent and maybe 1 bill. The other check you pay the rest of your bills. Then on the day you get paid, you just pay everything immediately and get it out of your account.

Whatever is left is food/gas/entertainment/savings.

You also need some system to keep track of what needs to be paid and when, I just use a Google Spreadsheet. Very basic.

:) That system is called budgeting and planning. :)

almost forgot about my checking account until I read that first paragraph haha. I’m too reliant on my SMS notifications when it alerts me to a deposit.

When you won the lottery like I did… managing money is something you pay someone else to do. And you don’t do it via SMS.

Hey Jeeves….. can you get my money manager on the phone please.

I think Algorithm is a much cooler name : D

Al Gorithm…

This is so incredibly sad.

Monthly, automated transfers to Betterment are a much better way to save and draw -serious- interest. Time to be a big-boy and manage your money for real…you’ll have to sooner rather than later.

I can second this. I’ve been doing monthly withdrawls into my Betterment account for about six months now and I’ve seen a great return on the investment. ETFs all the way.

What’s Betterment?

http://lmgtfy.com/?q=what+is+betterment

http://www.betterment.com/invite/mattvirus

Although this sounds like a great idea, I am a bit hesitant to give them free reign over my checking account.

An alternative suggestion that I’ve been doing for about a year or two now, is opening up an account with Simple. They give you a “safe to spend” amount, so when you create a savings goal and it’s taking out little chunks of money to move to that goal, the money is still in your actual account. It’s free with no fees, and comes with a regular Visa debit card too. Not sure what the opening transfer amount to get started is currently, but worth checking out if Digit is not something that interests you.

Either way, start saving today, even if it is small, you’d be surprised how quickly it adds up.

This story demonstrates the poor state of personal finance/economics education in our country (amongst other areas).

If you are having to live paycheck to paycheck (which is what I’m reading between the lines here) then you need to either talk to a financial planning expert, or go educate yourself.

It would seem that just talking to a student taking accounting in highschool would be a step in the right direction.

This is a terrible idea imo. I cringed as soon as I saw that you didn’t keep the interest from your savings.

I just use Mint. I make budgets and manually transfer anything I have left over 2500$ from my chequing account to a high interest savings account at the end of the month.

No one but me and my bank should have access to my bank account. Doing otherwise is more irresponsible than wasting your money for anything you see.

I let USAA connect to my outside accounts such as my car loan. It lets me gain access to everything in one place. Then again I trust USAA enough. Not sure about this Digit.

Best way to save? Direct deposit a portion of your paycheck into a high interest savings account at a different financial institution than your primary account. This way you never see the money in the first place. I’ve been doing this for years. $500 every paycheck, 24 paychecks a year. Then every quarter I have an automatic transfer from the account into a higher yield 36 month renewing CD. After 5 years of doing this I have 9 months of salary saved. Best part is it’s all automatic and I never miss it because I never see it.

I should note that you done need to be able to put back $1000 a month to be able to do this. $100 or even only $50 will work just fine.

I was about to reply not everyone can save 500/month.

If this was 1989 with money market interest rates at 9% then yeah. But today a high yield interest rate would be 1.5%. 36 months on a CD has a high opportunity cost lost. The best basic plan is to max your 401k and ira contributions that you can afford. The free money from employer matches and your tax deferring from contributions alone is worth the effort. Especially right now in the middle of a boom market you should be taking advantage while you can. This plan of attack will allow me to retire early in 10 years, well before I am 65.

I’ve already done that. This is just emergency cash savings.

I refuse to let an app skim money from my account. I started using YNAB a few years ago and then followed some other rules and now I have money every month. I have invested some and saved some as an emergency. The best way to get a handle is to take control of your money. It took me a year or two to get there but it is worth it.

This is a great business idea but a terrible idea for a user. Any online banking allows you to auto-transfer funds on schedule to your savings account within the same bank, whether it’s $1/day, $20/week, etc.

How I learned to stop worrying and love the bo– Oh wait. Wrong story.

I don’t like the trend in some apps where you are suppose to just let go and not think. That’s ok if we’re talking about an auto alert of that coffee pot that just dropped by $5.But finances and banking when we are still in the age of poor security just sounds like an impending disaster. Too many technologies are dumming us down. Finances should be a very basic thing that you have control over. You work every day for the money right? Well then shouldn’t you pay more attention to it?

Dumbing :)

It’s happening!!

No interest? That’s just stupid. You’d be better off just transfering a few dollars a week or month to a saving account that actually pays interest. Obviously how much “a few dollars” is will vary with your financial situation. Many saving accounts allow you to set up automatic recurring transfers from your checking account.